Suppose that in 2009, private investment spending was $500 billion, government investment was $300 billion, and depreciation was $250 billion. How much did the capital stock increase in 2009 (assume there were no other changes that affect the capital stock)?

a. $300 billion

b. $500 billion

c. $550 billion

d. $800 billion

e. $1.05 trillion

C

You might also like to view...

Fill in the blank: By 2011, GDP in the United States was approximately ________ times greater than it had been in 1820

A) 100 B) 225 C) 550 D) 775 E) 900

Marginal product equals 0 when:

A) average product equals zero. B) total product equals average product. C) average product reached its minimum value. D) total product reaches its maximum value.

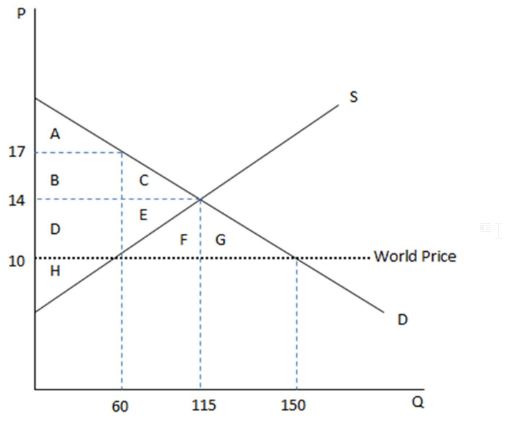

According to the graph shown, if this were depicting an autarky, the equilibrium price would be:

This graph demonstrates the domestic demand and supply for a good, as well as the world price for that good.

A. $10.

B. $14.

C. $17.

D. $4.

Which of the following statements is true about risk management in market systems versus command systems?

A. Market systems manage risk better because entrepreneurs taking risks bear the costs of poor decisions, where in command systems government decision makers don't bear those costs. B. Neither system is better than the other in terms of risk management; both systems are equally susceptible to natural disasters and changes in consumer preferences. C. Command systems manage risk better because the government controls most economic activity and can therefore eliminate risk. D. Market systems face risk because of the possibility of profits and losses; command systems don't face risk because they are not profit driven.