Which of the following will result in a decrease in the price of an existing corporate bond?

A) lower expectations of inflation

B) new bonds issued at a lower interest rate

C) increased default risk

D) all of the above

C

You might also like to view...

What was the source of the problems encountered by many financial firms during the late 2000s?

What will be an ideal response?

When the Fed reduces the money supply, it will cause a decrease in aggregate demand because:

A. real rates will rise, lowering business investment and consumer spending. B. the dollar will depreciate on the foreign exchange market, leading to an increase in net exports. C. lower interest rates will cause the value of assets (for example, stocks) to rise. D. the national debt will increase, causing consumers to reduce their spending.

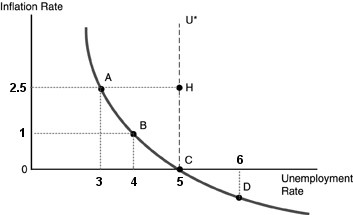

Refer to the above figure. Line ABCD is a(n)

Refer to the above figure. Line ABCD is a(n)

A. aggregate demand curve. B. natural rate of unemployment curve. C. Phillips curve. D. discretionary-policy curve.

When demand is elastic, a fall in price causes total revenue to rise because

A) when price falls, quantity sold increases so total revenue automatically rises. B) the increase in quantity sold is large enough to offset the lower price. C) the percentage increase in quantity demanded is less than the percentage fall in price. D) the demand curve shifts.