Research shows that people rearrange their income from different sources to reduce their:

A. tax rate.

B. necessary work hours.

C. total bill.

D. tax burden.

D. tax burden.

You might also like to view...

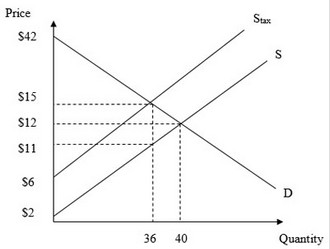

Use the figure below to answer the following question. What is the amount of producer surplus after the government imposes the excise tax on the market?

What is the amount of producer surplus after the government imposes the excise tax on the market?

A. $162 B. $540 C. $486 D. $180

If the Herfindahl-Hirschman index (HHI) among the firms in the long distance telecommunications market were equal to 1755, when would the Federal Trade Commission probably challenge a proposed merger between any two of the firms?

A) It would challenge if the HHI would increase by more than 50 points. B) It would challenge if the HHI would increase by more than 100 points. C) It would challenge no matter what happened to the HHI because the market has so few firms. D) It would not challenge because the HHI is less than 1800.

An anticipated change in the money supply will result in a(n) __________ level of economic activity and a __________ price level

A) increased; higher B) decreased; higher C) unchanged; lower D) unchanged; higher

Ziva is an organic lettuce farmer, but she also spends part of her day as a professional organizing consultant. As a consultant, Ziva helps people organize their houses. Due to the popularity of her home-organization services, Farmer Ziva has more clients requesting her services than she has time to help if she maintains her farming business. Farmer Ziva charges $25 an hour for her

home-organization services. One spring day, Ziva spends 10 hours in her fields planting $130 worth of seeds on her farm. She expects that the seeds she planted will yield $300 worth of lettuce. Ziva's accountant would calculate the total cost for the day of farming to equal a. $25. b. $130. c. $300. d. $380.