The earned income tax credit (EITC) is, in essence:

A. A tax credit for corporate contributions to charity

B. A tax break for businesses that invest in community programs

C. An income payment to those individuals who are not able to work

D. A wage subsidy for low-income workers to offset Social Security taxes

D. A wage subsidy for low-income workers to offset Social Security taxes

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. When formulating an economic model, one must explicitly identify both an agent's objectives and his constraints. 2. Costs are forgone opportunities. 3. The first step in economic analysis is to choose an appropriate equilibrium condition. 4. An economic problem can be defined as any problem involving money. 5. Economists focus only on real world consumer choices.

In order for pollution taxes to be effective in eliminating the deadweight loss resulting from pollution, the pollution tax must be set equal to the

A) marginal private cost. B) marginal external cost. C) marginal social cost. D) marginal benefit of polluting. E) price of the good.

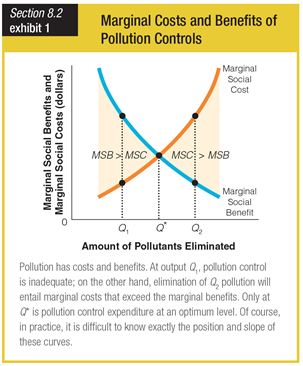

In this graph for the marginal costs and benefits of pollution controls, at output level Q*, pollution control is ______.

a. unnecessary

b. optimized

c. insufficient

d. excessive

According to the law of demand:

A. Price and quantity demanded are inversely related. B. Price is constant along a particular demand curve. C. The demand curve will shift rightward as price increases. D. Businesses will produce more as price increases.