The United States has had:

A. high relative mobility in the last century, and lower absolute mobility.

B. low absolute mobility in the last century, but higher relative mobility.

C. high absolute mobility in the last century, and lower relative mobility.

D. low relative mobility in the last century, and even lower absolute mobility.

C. high absolute mobility in the last century, and lower relative mobility.

You might also like to view...

All of the following are characteristics of a bond except

A) the coupon payment is the interest payment on the bond. B) a bond represents a promise to repay a fixed amount of funds. C) bonds generally pay dividends each year. D) the face value is repaid when the bond matures.

Answer the following statements true (T) or false (F)

1. Government intervention in the U.S. economy includes legislation such as antitrust laws, labor laws, and safety regulations. 2. Full employment is considered to have been achieved only when everybody in the economy has a job. 3. An economic growth rate of 3 percent would be considered unhealthy for the U.S. economy. 4. A stable unemployment rate requires that the U.S. economy grow each year in order to absorb new workers who enter the labor force.

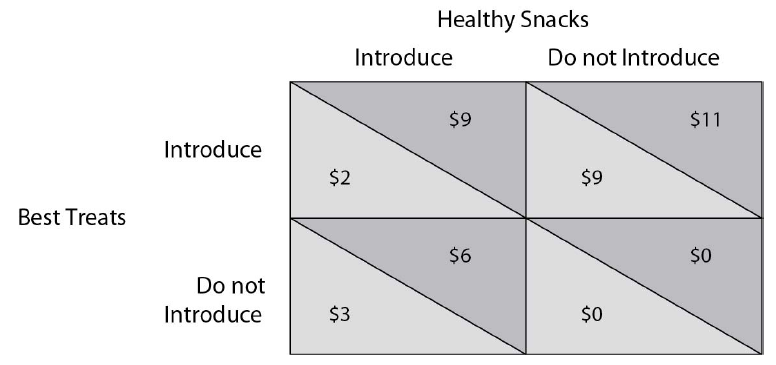

Refer to the payoff matrix below. If Best Treats announces that it will introduce the new health snack, Healthy Snacks ________ believe Best Treats as their incentives ________ align.

Healthy Snacks and Best Treats are two firms competing in the health food snacks market. Both are considering introducing a new health food snack made purely of dried power fruits. The payoff matrix shows their net economic profit in millions for the different strategies.

A) should not; do

B) should; do

C) should not; do not

D) should; do not

Which of the following statements is correct?

a. Equity is more important than efficiency as a goal of the tax system. b. Efficiency is more important than equity as a goal of the tax system. c. Both equity and efficiency are important goals of the tax system. d. Neither equity nor efficiency is an important goal of the tax system.