Answer the following statement(s) true (T) or false (F)

1. Producer's surplus is equal to total revenue minus consumer's surplus.

2. The efficiency criterion is normative in nature.

3. According to the efficiency criterion, when a policy creates both winners and losers, it will be preferred to the status quo as long as the winners' gains outweigh the losers' losses.

4. A given level of output is efficient if no more social gain can be obtained from changing the output level.

5. A $5 per unit sales tax is bad for consumers because it implies that the total amount (price plus tax) that they must pay increases by $5.

1. False

2. True

3. True

4. True

5. False

You might also like to view...

Consider a worker who consumes a composite consumption good (on the vertical axis) and leisure hours (on the horizontal axis).

a. Suppose the worker has 80 hours of leisure per week and can earn a wage of $50 per hour. Illustrate the worker's weekly budget constraint. b. In order to close the deficit, the government introduces a broad-based consumption tax on all consumer goods -- raising the price of the consumption good by 20%. Illustrate the new budget constraint faced by our worker. c. On your graph, indicate the level of tax revenue raised by this broad-based consumption tax. d. Using your graph, discuss why this tax is inefficient. e. In this model is there any difference between the consumption tax and a wage tax? What is different about the real world that would change your conclusion about this? What will be an ideal response?

If the government decreases taxes, which of the following would occur?

a. An increase in GDP, an increase in the price level, an increase in money demand, and an increase in the interest rate b. An increase in GDP, a decrease in the price level, an increase in money demand, and a decrease in the interest rate c. A decrease in GDP, a decrease in the price level, a decrease in money demand, and a decrease in the interest rate d. A decrease in GDP, a decrease in the price level, an increase in money demand, and an increase in the interest rate e. An increase in GDP, an increase in the price level, a decrease in money demand, and a decrease in the interest rate.

Dan is the owner of a price-taking company that manufactures sporting goods. One particular facility Dan owns produces baseball bats and baseball gloves. His cost function for baseball bats is CB(QB, QG) = 100QB + QB2 + QBQG and the marginal cost is MCB = 100 + 2QB + QG, where QB is the output level for bats and QG is the output level for gloves. Dan's cost function for baseball gloves is CG(QB, QG) = 50QG + QG2 + QGQB, and the marginal cost is MCG = 50 + 2QG + QB. The price of a baseball bat is $240 and the price of a baseball glove is $150. How would the profit-maximizing sales quantities for bats and gloves change if the price of bats was $270?

A. The quantities of bats and gloves will remain unchanged. B. The quantity of gloves will increase while the quantity of bats will decrease. C. The quantity of bats will increase while the quantity of gloves will decrease. D. The quantities of bats and gloves will both increase.

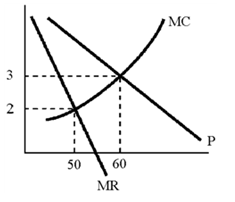

Figure 11-3

A. MR < P. B. MC = P. C. MC < AC. D. MR = P.