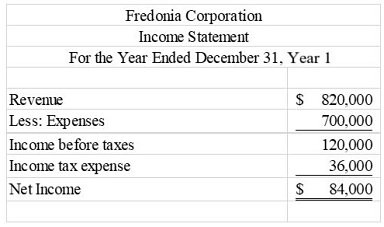

On January 1, Year 1, the organizers of Fredonia Corporation obtained their charter authorizing 400,000 shares of $2 par common stock. Fredonia issued 30,000 shares of $2 par common stock for $8 per share. During Year 1, the corporation earned $820,000 in cash revenue and paid $700,000 in cash expenses, not including income tax. The company declared and paid cash dividends totaling $28,000. Fredonia Corporation is in the 30% tax bracket. Required:Using the above information, prepare an income statement and a balance sheet for the Fredonia Corporation.

What will be an ideal response?

| Fredonia Corporation | |

| Balance Sheet | |

| As of December 31, Year 1 | |

| ? | ? |

| Assets | ? |

| Cash | $ 296,000 |

| ? | ? |

| Stockholders' Equity | ? |

| Common stock | $ 60,000 |

| Paid-in capital in excess of par value-common | 180,000 |

| Retained earnings | 56,000 |

| Total Stockholders' Equity | $ 296,000 |

| ? | ? |

Common stock = 30,000 shares × Par value of $2 = $60,000

Paid-in capital in excess of par value-common = 30,000 shares × (Issue price of $8 per share ? Par value of $2 per share) = $180,000

You might also like to view...

Mars Services, Inc pays $700,000 to acquire 35% (200,000 shares) of voting stock of Grey Investments, Inc on January 5, 2017

Grey Investments, Inc declares and pays a cash dividend of $2.4 per share on June 14, 2017. Which of the following is the correct journal entry for the transaction on June 14, 2017? A) Long-term Investments-Grey Investments, Inc. 480,000 Cash 480,000 B) Cash 480,000 Dividend Revenue 480,000 C) Cash 480,000 Long-term Investments-Grey Investments, Inc. 480,000 D) Cash 480,000 Long-term Investments-Mars Services, Inc. 480,000

True or False When events A and B are independent, then P(A and B) = P(A) + P(B)

Indicate whether the statement is true or false

Andy filed a fraudulent 2019 tax return on May 1, 2020. The statute of limitations for IRS assessment on Andy's 2019 tax return should end:

A. April 15th, 2023. B. May 1st, 2023. C. May 1st, 2026. D. April 15th, 2026. E. None of the choices are correct.

Business processes involve resources, such as people, computers, and data and document collections

Indicate whether the statement is true or false