Which of the following résumé formats are likely to be incompatible with traditional applicant tracking systems and screening habits of recruiters?

A) PDF file résumés

B) Online résumés

C) Infographic résumés

D) Microsoft Word file résumés

E) Printed scannable résumés

Answer: C

Explanation: C) A well-designed infographic could be an intriguing element of the job-search package for candidates in certain situations and professions because it can definitely stand out from traditional résumés and can show a high level of skill in visual communication. However, infographics are likely to be incompatible with most applicant tracking systems and with the screening habits of most recruiters, so while you might stand out with an infographic, you might also get tossed out if you try to use an infographic in place of a conventional résumé.

You might also like to view...

The payment made each period on an amortized loan is constant, and it consists of some interest and some principal. The closer we are to the end of the loan's life, the greater the percentage of the payment that will be a repayment of principal.

Answer the following statement true (T) or false (F)

During situations of low familiarity, many types of mediators may be used in cross-cultural negotiations, known as a ________ strategy.

Fill in the blank(s) with the appropriate word(s).

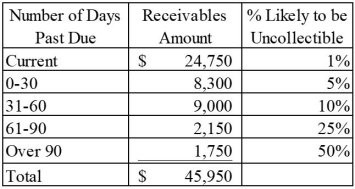

Chico Company began Year 2 with balances in accounts receivable and allowance for doubtful accounts of $44,300 and $1,675, respectively. The company reported credit sales of $490,250 during the year, and wrote off $1,400 of uncollectible accounts. Chico Company prepared the following aging schedule on December 31, Year 2: Required:a) Prepare these general journal entries: (1) Credit sales (2) Collection of accounts receivable (3) Write-off of uncollectible accounts (4) Adjusting entry for uncollectible accountsb) Determine the net realizable value of accounts receivable.

Required:a) Prepare these general journal entries: (1) Credit sales (2) Collection of accounts receivable (3) Write-off of uncollectible accounts (4) Adjusting entry for uncollectible accountsb) Determine the net realizable value of accounts receivable.

What will be an ideal response?

The accounts receivable turnover ratio indicates whether a company could pay all its current liabilities if they were to become due immediately

Indicate whether the statement is true or false