Suppose that a nation has adopted a fixed exchange rate with another country, and has a persistent trade deficit. What is most likely to happen?

a. a gradual increase in the value of its currency

b. a gradual decrease in the value of its currency

c. a "run" on its currency and a sudden appreciation

d. a "run" on its currency and a sudden devaluation

d

You might also like to view...

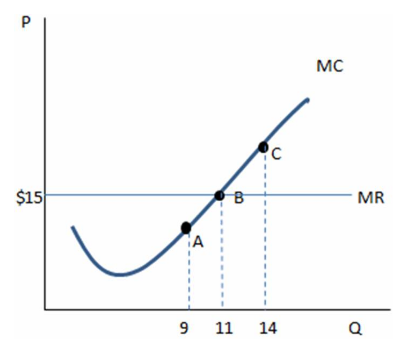

If a marginal cost pricing rule is imposed on the natural monopoly in the figure above, then total surplus will be

A) $0. B) $4 million. C) $8 million. D) $16 million.

Because Treasury bills pay a higher return than money and have no risk

A) the transactions demand for money may be zero. B) the precautionary demand for money may be zero. C) the speculative demand for money may be zero. D) all three of the above motives for holding money will be zero.

According to the graph shown, at point C the firm is earning:

A. higher profits than at point B, and they should produce more.

B. fewer profits than at point B, and they should produce more.

C. fewer profits than at point B, and they should produce less.

D. higher profits than at point B, and they should produce less.

An upward-sloping line or curve is used to illustrate:

a. a direct relationship. b. an inverse relationship. c. two unrelated variables. d. the ceteris paribus assumption.