Auditing standards describe three conditions that are usually found to be present when fraud exists. What are those three conditions and what red flags, if any, might be present at Longeta?

What will be an ideal response?

Paragraph .65 of PCAOB AS 2110, “Identifying and Assessing Risks of Material Misstatement,” states

"The auditor should evaluate whether the information gathered from the risk assessment procedures

indicates that one or more fraud risk factors are present and should be taken into account in identifying

and assessing fraud risks. Fraud risk factors are events or conditions that indicate (1) an incentive

or pressure to perpetrate fraud, (2) an opportunity to carry out the fraud, or (3) an attitude or

rationalization that justifies the fraudulent action. Fraud risk factors do not necessarily indicate the

existence of fraud; however, they often are present in circumstances in which fraud exists."

The most notable fraud risk factor relates to the incentive of the vice president of sales to ensure the

transaction was recorded. The vice president's job performance and related compensation provided a

strong incentive to record the transaction before year end. Other members of management may have

similar incentives to capture the transaction in that year. In addition to fraud risk factors related to the

incentives condition, the willingness of Longeta's accounting function to record a transaction without

a reseller's agreement in place suggests that Longeta's internal controls over financial reporting were

deficient. Furthermore, the wording in the vice president's letter stating that "The order letter meets

GAAP requirements" also suggests that some discussion must have transpired between the vice president

of sales and the accounting staff that raised awareness about concerns that were ignored related to

the correct accounting treatment for the transaction. That provides a red flag about management's

willingness to rationalize recording the transaction despite noted concerns about the appropriateness

of doing so.

You might also like to view...

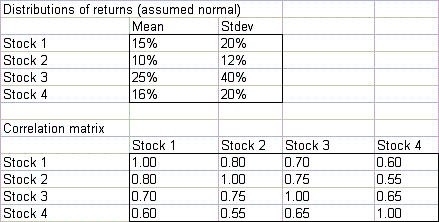

Suppose you have invested 25% of your portfolio in four different stocks. The mean and standard deviation of the annual return on each stock are as shown below. The correlations between the annual returns on the four stocks are also shown below.

What will be an ideal response?

When the FIFO costing method is used in process costing, the number of units in beginning inventory is multiplied by 100 percent to determine the equivalent units

Indicate whether the statement is true or false

Cultural differences between countries may make performance evaluation in multinational settings more difficult

Indicate whether the statement is true or false

Why are auction sales and sales "otherwise by authority of law" excluded from the CISG?

What will be an ideal response?