A friend tells you he is studying the incidence of the corporate income tax. What is the subject of his study?

A. how the burden of corporate taxation is distributed among stockholders, employees, and consumers

B. how inflation affects the amount of tax revenue collected from firms

C. how frequently corporations should be taxed

D. how corporations can aid the government in collecting delinquent taxes

Answer: A

You might also like to view...

Assume that firms A and B have the same minimum efficient scale of operation and, at current production levels, both firms are incurring the same average costs of production. However, firm A's output is 5 times larger than firm B's output

How is this possible?

The third largest source of government tax revenues that contributes roughly 10 percent to total revenues is:

A. payroll tax. B. personal income tax. C. corporate income tax. D. excise tax.

The kinked demand curve is always associated with ___________ competition.

Fill in the blank(s) with the appropriate word(s).

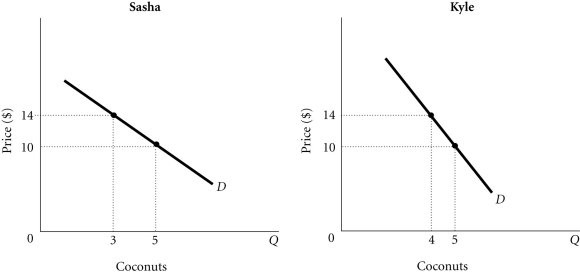

Refer to the information provided in Figure 3.9 below to answer the following question(s). Figure 3.9Refer to Figure 3.9. Assume there are only two people in the market for coconuts: Sasha and Kyle. Along the ________, at a price of $10, quantity demanded would be 5.

Figure 3.9Refer to Figure 3.9. Assume there are only two people in the market for coconuts: Sasha and Kyle. Along the ________, at a price of $10, quantity demanded would be 5.

A. demand curve for Kyle only B. market demand curve C. demand curve for either Sasha or Kyle D. demand curve for Sasha only