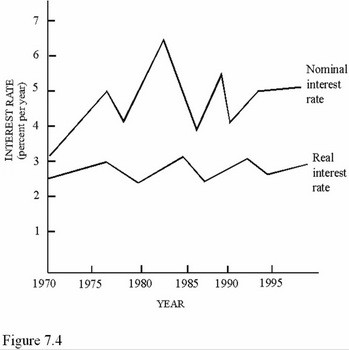

Consider the economy represented in Figure 7.4. If actual inflation was greater than anticipated inflation,

Consider the economy represented in Figure 7.4. If actual inflation was greater than anticipated inflation,

A. The Federal Reserve would be forced to step in to increase lending.

B. Lenders would experience a decrease in real income.

C. Lenders would experience an increase in real income.

D. Borrowers would experience a decrease in real income.

Answer: B

You might also like to view...

Countries that use the euro as their currency face similar concerns as countries did during the years of the gold standard in that each are (were)

A) using a floating currency. B) unable to conduct fiscal policy. C) unable to conduct monetary policy. D) using currency which is backed by gold.

The existence of recessions highlights

a. the strengths of the Federal Reserve b. the need for the "other things equal" assumption c. our failure to consider differences between the short run and long run d. how confusing the economy can become e. the interdependence between production and income

When the BEA calculates real GDP using the average of prices in the current year and the year preceding it, and this average changes from year to year, this is called calculating GDP using

A) chained-weighted prices. B) fixed-weight prices. C) current-year prices. D) fixed base-year prices.

On any given day, a salesman can earn $0 with a 30% probability, $100 with a 20% probability, or $300 with a 50% probability. His expected earnings equal

A) $0. B) $100. C) $150. D) $170.