The ________ rule specifies that each entity instance of the super-type must be a member of some subtype of the relationship

A) Partial specialization

B) Business

C) Overlap

D) Total specialization

D

You might also like to view...

Answer the following statements true (T) or false (F)

1. Corporations may not retire preferred stock in order to avoid paying the preferred dividends. 2. A profitable corporation may make distributions to stockholders in the form of bonuses. 3. Dividends can be paid in the form of cash, stock, or other property. 4. Cash dividends cause a decrease in both assets and stockholders' equity of the corporation. 5. The declaration of a cash dividend does not create an obligation for the corporation.

Which of the following accounting principles require that all goods and services purchased be recorded at actual cost?

A. Expense recognition (Matching) principle. B. Consideration assumption. C. Business entity assumption. D. Going-concern assumption. E. Measurement (Cost) principle.

Ezinne transfers land with an adjusted basis of $50,000 and a FMV of $95,000 to a new business in exchange for a 50% ownership interest. The land is subject to a $60,000 mortgage which the business will assume. The business has no other liabilities outstanding. Indicate the amount of gain recognized by Ezinne due to this exchange if the building is transferred to (1) a corporation and (2) a

partnership. Assume Sec. 351 is satisfied in the case of the corporation and Sec. 721 is satisfied in the case of the partnership.

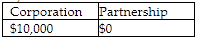

A)

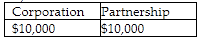

B)

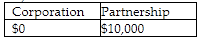

C)

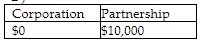

D)

If cost variance is a positive number, it means that performing the work costs more than planned

a. True b. False Indicate whether the statement is true or false