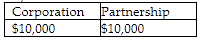

Ezinne transfers land with an adjusted basis of $50,000 and a FMV of $95,000 to a new business in exchange for a 50% ownership interest. The land is subject to a $60,000 mortgage which the business will assume. The business has no other liabilities outstanding. Indicate the amount of gain recognized by Ezinne due to this exchange if the building is transferred to (1) a corporation and (2) a

partnership. Assume Sec. 351 is satisfied in the case of the corporation and Sec. 721 is satisfied in the case of the partnership.

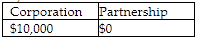

A)

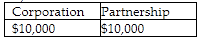

B)

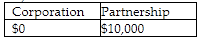

C)

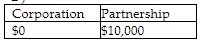

D)

B)

In the corporate situation, the shareholder recognizes gain to the extent that total liabilities exceed the basis of property transferred ($60,000 mortgage - $50,000 adjusted basis = $10,000 gain recognized). In the partnership form, the transferor partner recognizes gain only if the personal liability relief exceeds the partner's basis in the partnership, after taking into account the partner's basis adjustment for her share of partnership liabilities ($50,000 property adjusted basis + $30,000 share of mortgage - $60,000 personal liability relief = $20,000 partnership basis). Since her basis in the partnership is not negative, no gain is recognized.

You might also like to view...

Common accounting anomaly fraud symptoms involve problems with various data and books of accounts. Which of the following is NOT one among them?

a. Faulty journal entries b. Inaccuracies in source documents c. Rounding adjustments d. Inaccuracies in ledgers

A leasehold is a payment

A) for the right to use certain property. B) for the right to sublease certain property. C) to give up or to get out of a lease. D) to improve leased property.

What is liberation management? What are its implications for HRM?

What will be an ideal response?

Secondary boycott picketing is legal if it is directed only at the specific products of the workers'

employer. Indicate whether the statement is true or false