Consider the Japanese market for jetliners as depicted in Figure 6.5. Suppose the lone producer of jetliners in the world is Boeing, which faces a constant marginal cost of $20 million per jetliner, but now a European manufacturer, Airbus, begins production. Airbus faces the same marginal cost as Boeing, but the European government provides Airbus with a subsidy of $8 million per jetliner produced. As a result of the competition, Boeing leaves the Japanese market leaving Airbus as a monopoly. How much profit will Airbus earn?

a. $230 million

b. $350 million

c. $416 million

d. $450 million

c. $416 million

You might also like to view...

The entry to replenish the petty cash fund for $250 of various minor expenses would include a

A) debit to Petty Cash for $250. B) debit to Cash for $250. C) credit to Petty Cash for $250. D) credit to Cash for $250.

________ are an attractive way of illustrating trends and changes over time

A) Line charts B) Pictographs C) Bar charts D) Histograms

A company with a primarily regional strategic orientation may adopt a(n) ______ staffing policy.

Fill in the blank(s) with the appropriate word(s).

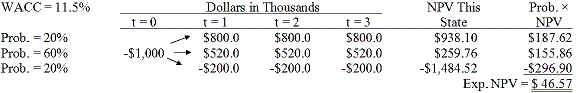

Brandt Enterprises is considering a new project that has a cost of $1,000,000, and the CFO set up the following simple decision tree to show its three most likely scenarios. The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. How much is the option to abandon worth to the firm?

A. $55.08 B. $57.98 C. $61.03 D. $64.08 E. $67.29