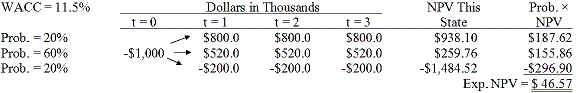

Brandt Enterprises is considering a new project that has a cost of $1,000,000, and the CFO set up the following simple decision tree to show its three most likely scenarios. The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. How much is the option to abandon worth to the firm?

A. $55.08

B. $57.98

C. $61.03

D. $64.08

E. $67.29

Answer: C

You might also like to view...

Intraperiod tax allocation requires a corporation's total income tax expense to be allocated to all of the following except

A) any items of other comprehensive income. B) other revenues and expenses. C) discontinued operations. D) prior-period adjustments.

According to the Brand Asset Valuator (BAV) model, which of the following is one of the key dimensions of brand equity?

A) sophistication B) excitement C) competence D) differentiation

The presence of business skills will increase the opportunities available to a technical professional and increase his or her speed of advancement.

Answer the following statement true (T) or false (F)

Which of these is a trademark?

A. Big Mac B. Weight Watchers C. Grown in Idaho D. Realtor