According to research, after the Tax Reform Act of 1986, the effective marginal tax rate on equipment has

A. decreased substantially.

B. stayed basically the same.

C. increased.

D. decreased slightly.

C. increased.

You might also like to view...

Michael Woodford says the following is an advantage of interest-rate instruments for central banks

A) Conduct monetary policy without inflation. B) Conduct monetary policy even if checking deposits pay interest at competitive rates. C) Conduct monetary policy without government approval. D) Conduct monetary policy with consumers in mind. E) Conduct monetary policy with workers in mind.

To lower long-term interest rates, in 2010 the Fed started its new open market operation program to purchase

A) mortgage-backed securities. B) commercial papers. C) long-term Treasuries. D) Treasury bills and Treasury notes.

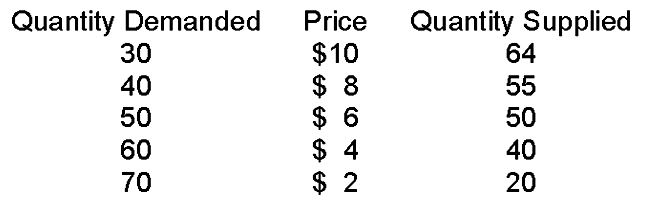

If the government set a price ceiling at $8

A. there would be a temporary surplus, then prices would fall to equilibrium.

B. there would be a permanent surplus, at least until the price floor was lifted.

C. the price would fall back to the equilibrium price.

D. the price floor would not have any effect on this market.

Nominal GDP measures

a. the total quantity of final goods and services produced. b. the dollar value of the economy's output of final goods and services. c. the total income received from producing final goods and services measured in constant dollars. d. the overall level of prices.