Tax law uncertainty is the risk that the Internal Revenue Service will challenge a taxpayer's tax treatment on audit.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Discuss single-source data. What is it and how is it related to computer mapping?

What will be an ideal response?

Having less political involvement, resulting in being more truthful with less consequence is an example of which of the following?

a. advantage of internal consulting b. advantage of external consulting c. disadvantage of internal consulting d. disadvantage of external consulting

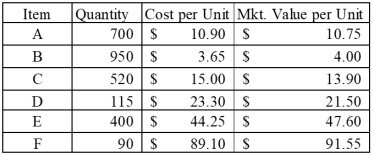

The Rowe Company has six different categories of inventory. Quantity, cost, and market value information for each inventory category is shown below:  Required: a) Determine the value of ending inventory after applying the lower-of-cost-or-market rule to each individual category of inventory.b) Determine the value of ending inventory after applying the lower-of-cost-or-market rule to the entire stock of inventory in the aggregate.c) Prepare the journal entry, if required, to adjust inventory for part (a) above.d) Prepare the journal entry, if required, to adjust inventory for part (b) above.

Required: a) Determine the value of ending inventory after applying the lower-of-cost-or-market rule to each individual category of inventory.b) Determine the value of ending inventory after applying the lower-of-cost-or-market rule to the entire stock of inventory in the aggregate.c) Prepare the journal entry, if required, to adjust inventory for part (a) above.d) Prepare the journal entry, if required, to adjust inventory for part (b) above.

What will be an ideal response?

Being ____ means seeing the world from your own point of view, assuming you are the norm or center.

A. evolved B. normalized C. egocentric D. socially conditioned