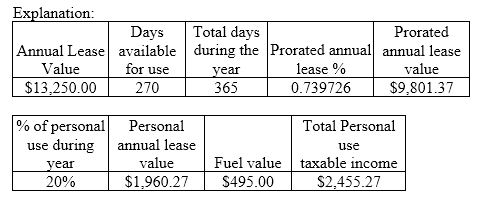

Michael McBride is an employee of Reach-it Pharmaceuticals. His company car is a 2017 Lexus GS 200t with a fair-market value of $50,000 and a lease value of $13,250, according to Publication 15-b. During the year, Michael drove 45,000 miles, of which 9,000 were for personal use. The car was available for use on 270 of the days during the year. All gasoline was provided by the employer and is

charged back to Michael at $0.055 per mile. What is the amount of the company-car fringe benefit that will appear on Michael's W-2, using the lease-value rule? (Do not round intermediate calculations, only round final answer to two decimal points.)

A) $2,742.77

B) $2,455.27

C) $2,156.87

D) $1,960.27

B) $2,455.27

You might also like to view...

A crisis does not always have to be viewed negatively. It can be an opportunity for a company to improve its position in the market and enhance its image

Indicate whether the statement is true or false

A company is referred to as a parent if it owns

a. 33% of the debt securities of a second company b. 100% of the debt securities of a second company c. 15% of the equity securities of a second company d. None of these choices

Fixed compensation receives more emphasis in sales rep jobs with ________

A) a high ratio of selling to nonselling duties B) a high requirement for individual initiatives C) an intensive focus on selling activities D) very little need for teamwork E) technical complexities

A firm can benchmark its current performance against its own prior performance, specific competitors, and high performance retailers

Indicate whether the statement is true or false