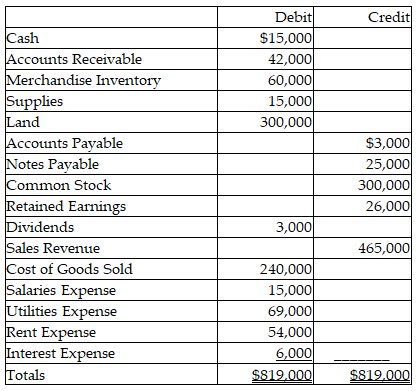

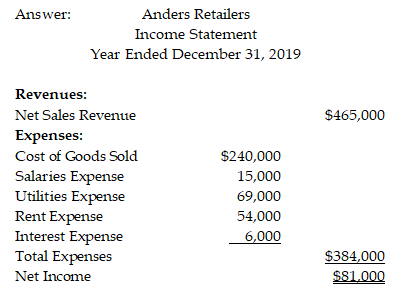

An adjusted trial balance of Anders Retailers as of December 31, 2019 is given below. Prepare a single-step income statement for the year for the company.

You might also like to view...

Suppose an investor purchased 100 shares of JDSU stock at a price of $50 per share on December 31, 2011. On December 31, 2012, JDSU paid dividends of $1.50 per share, and the investor received the dividends, then sold the stock at a price of $65 per share. a.If there were no taxes or inflation, what was the total return? b.If there were no taxes, but inflation was 3.5 percent, what was the real return? c.If the tax rate was 15 percent on dividends and capital gains, what was the after-tax real return?

What will be an ideal response?

Which of the following refers to a situation where downward price moves by one competitor force "follower moves" by other competitors in order to minimize lost profits?

A) a technology trap B) competitive benchmarking C) the prisoner's dilemma D) a monopoly market E) a free market situation

The amount journalized showing the cost added to finished goods is taken from the cost of production report

Indicate whether the statement is true or false

The best quantitative evidence of whether a company's present strategy is working well is

A. whether the company has a shorter value chain than close rivals. B. whether the company is in the industry's best strategic group. C. whether the company is in the Fortune 500. D. the caliber of results the strategy is producing, specifically whether the company is achieving its financial and strategic objectives and whether it is an above-average industry performer. E. whether the company has more competitive assets than it does competitive liabilities.