If the United States imposes a tariff on foreign chocolate, how are foreign producers of chocolate affected?

A) Their supply is unaffected because the quota must be met by U.S. producers.

B) They export less to the United States.

C) Their supply increases because they have to pay the tariff.

D) The tariff has no effect on foreign producers because U.S. consumers must pay the higher price.

E) They earn more profit because their chocolate sells for a higher price.

B

You might also like to view...

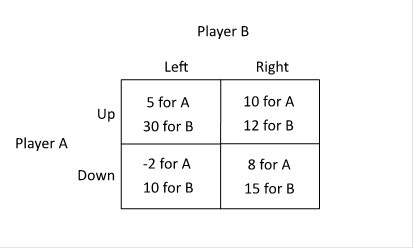

Refer to the figure below. Player B can infer that Player A will:

A. always choose Up. B. always choose Down. C. choose Up when B chooses Left and choose Down when B chooses Right. D. choose Down when B chooses Left and choose Up when B chooses Right.

A government wants to build a hydroelectric dam to reduce flooding in a region and provide electricity to its people

What type of investment is this? In order to make a decision about whether or not to make the investment, how should the government evaluate this project?

If inventory investment during a year was minus $6 billion, producers must have

a. produced only $6 billion of new capital assets during the year. b. sold $6 billion more goods and services during the year than they produced. c. added goods valued at $6 billion to their stock of unsold goods and raw materials. d. produced new capital assets that exceeded the depreciation allowance by $6 billion.

Thompson Corporation is considering the purchase of a new piece of machinery. Thompson expects the new machinery to increase its revenues by $70,000 at the end of year 1, $60,000 at the end of year 2, and $50,000 at the end of year 3 at which point the

machinery will have exhausted its useful life. If the interest rate is 4%, what is the most Thompson should be willing to pay today for this piece of machinery?