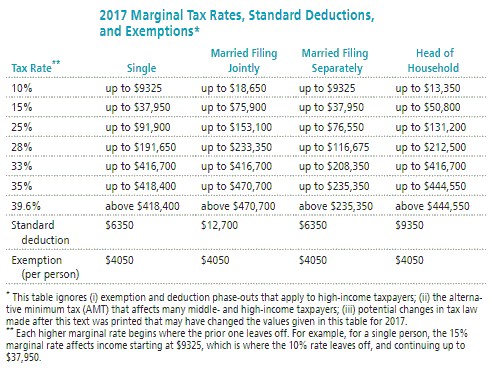

Solve the problem. Refer to the table if necessary. Kelly earned wages of

Kelly earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. She was entitled to a personal exemption of

to a tax deferred retirement plan. She was entitled to a personal exemption of

style="vertical-align: -4.0px;" /> and had deductions totaling  Find her gross income.

Find her gross income.

A. $84,228

B. $97,051

C. $103,220

D. $109,389

Answer: C

You might also like to view...

Solve the problem. Refer to the table if necessary. Your deductible expenditures are $9135 for interest on a home mortgage, $3722 for contributions to charity, and $579 for state income taxes. Your filing status entitles you to a standard deduction of $12,700. Should you itemize your deductions rather than claiming the standard deduction? If so, what is the difference?

Your deductible expenditures are $9135 for interest on a home mortgage, $3722 for contributions to charity, and $579 for state income taxes. Your filing status entitles you to a standard deduction of $12,700. Should you itemize your deductions rather than claiming the standard deduction? If so, what is the difference?

A. Yes, $736 B. Yes, -$422 C. No, you are better off with the standard deduction. D. Yes, $26,136

Use the information given about the angle ?, 0 ? ? ? 2?, to find the exact value of the indicated trigonometric function.sin ? = -  ,

,  < ? < 2?Find cos

< ? < 2?Find cos  .

.

A.

B. -

C. -

D.

Establish the identity.(sin x)(tan x cos x - cot x cos x) = 1 - 2 cos 2 x

What will be an ideal response?

Use the Half-angle Formulas to find the exact value of the trigonometric function. tan 165°

A. -2 -

B. 2 -

C. 2 +

D. -2 +