a. The buyer has more information than the seller about whether they are high or low risk.

a. Asymmetric information

b. Imperfect information

c. Adverse selection

d. Moral hazard

a. Asymmetric information

You might also like to view...

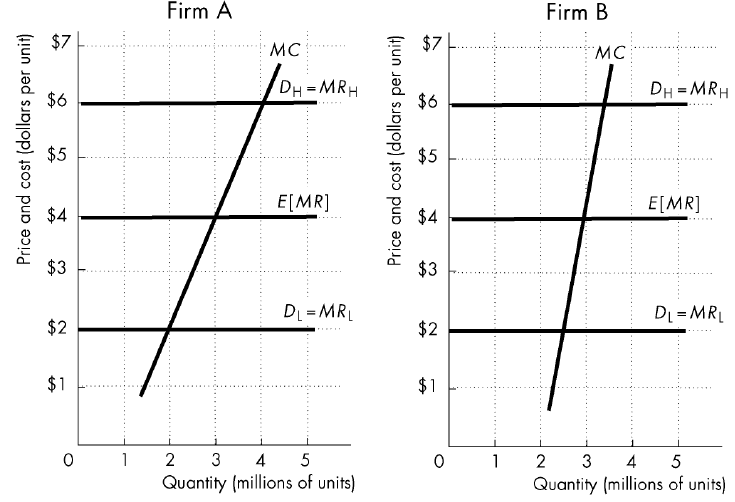

Two perfectly competitive firms, Firm A and Firm B, both face random demand and have the same expected marginal revenue, as illustrated in the figure below. For which firm would a forecast of demand be more valuable?

A) Firm A

B) Firm B

C) The value for each firm is the same because the high demand, low demand, and expected marginal revenue are the same.

D) A forecast is more valuable for Firm A if the demand will be high and more valuable for Firm B if the demand will be low.

Discuss research on the role of banks and other financial institutions in the intermediation of funds between lenders and borrowers

What will be an ideal response?

Economists assume that

A) individuals behave in unpredictable ways. B) consumer behavior is explained by the existence of unlimited resources. C) people put other people's interests ahead of their own. D) optimal decisions are made at the margin.

The tax incidence of a specific tax or ad valorem tax is influenced by

A) who pays the tax. B) the amount of the tax. C) the price elasticities of supply and demand. D) All of the above.