On November 7, a calendar year business placed in service $900,000 of 3-year recovery property. If this was the only property placed in service during the year, MACRS depreciation is computed using the:

A. Mid-year convention

B. Daily pro-ration method

C. Mid-month convention

D. Mid-quarter convention

Answer: D

You might also like to view...

When selecting between the best alternatives regarding an ethical dilemma in accounting all of the following should be considered except:

a. which alternative provides the most relevant information. b. which alternative provides the most accurate information. c. which alternative provides the most neutral information. d. which alternative provides the most profitable information.

What is the profitability index for Project B? (Round your answer to two decimal places.)

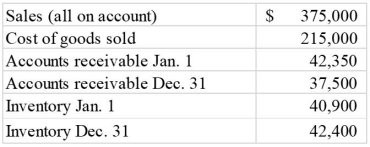

The following information is provided by Rojas Company:

A) 1.92

B) 1.36

C) 1.25

D) 1.87

The following information is available from Avalon, Inc. for the current year: During the year, the average number of days to sell inventory was 76.1 days. Required:Calculate the following. (Round your answers to one decimal place.)a) Accounts receivable turnover ratiob) Average number of days to collect accounts receivablec) Length of operating cycled) Net cash flow from sales

During the year, the average number of days to sell inventory was 76.1 days. Required:Calculate the following. (Round your answers to one decimal place.)a) Accounts receivable turnover ratiob) Average number of days to collect accounts receivablec) Length of operating cycled) Net cash flow from sales

What will be an ideal response?

The use by a company of its competitive advantage to achieve more advantage in surrounding markets is known as ________

A) market strategy B) differentiation C) leverage D) focus