The progressive income tax is an automatic stabilizer with respect to the Federal government's budget surplus or deficit because

A) individuals must "automatically" pay taxes even when they have a deficit.

B) during periods of output growth, a greater percentage of real income "leaks" from the expenditure stream.

C) during periods of output growth, the marginal leakage rate increases as taxes decrease.

D) None of the above.

B

You might also like to view...

The reform movements that began in many Latin American economies in the late 1980s favored

A) competitive devaluations. B) stronger military budgets. C) imports substitution policies. D) a stronger role for markets and more openness. E) more government regulation of industry.

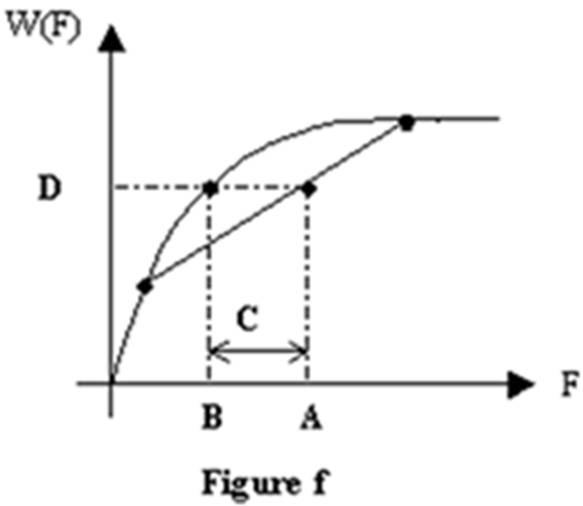

Refer to Figure f. A benefit function is plotted in Figure f. The letter B represents the:

A. risk premium of the consumption bundle.

B. expected utility of the consumption bundle.

C. certainty equivalent of the consumption bundle.

D. expected consumption.

For which pair of firms would a merger be horizontal?

a. Avis Car Rentals and United Airlines b. Coca-Cola and Nike c. Barnes and Noble and Borders bookstores d. Dominos Sugar and Dominos Pizza e. Samuel Adams Beer and Samsonite Luggage

Talking about alternatives is the first step in a process that helps us make better choices about how we use our resources.

Answer the following statement true (T) or false (F)