Which of the following types of intellectual property is protected by the Lanham Act?

A. a trade secret

B. a trademark

C. a copyright

D. a patent

Answer: B

You might also like to view...

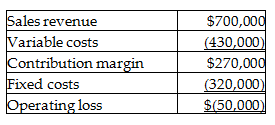

Castillo has just encountered environmental problems with the product and will be forced to drop the product line altogether. Castillo will be able to eliminate 60% of the fixed costs. What will be the impact on operating income of the company?

Castillo Corporation has provided you with the following budgeted income statement for one of its products:

A) Operating income will decrease by $192,000.

B) Operating income will decrease by $78,000.

C) Operating income will increase by $192,000.

D) Operating income will increase by $78,000.

Marcel Provost is a shareholder of Armstrong Realty Corp He is not engaged in the management of the company. The other shareholders are Baun and Brewer, and they run the business

Armstrong Realty purchases a piece of land from Baun and Brewer for $100,000. Provost learns that the land is worth only $50,000. Which of the following is true? A) The corporation has acted in a way that unfairly disregarded Marcel's right as a shareholder. B) The court could set aside the contract between Baun and Brewer and Armstrong Realty. C) The court could order Armstrong to purchase Provost's shares D) Both A and C E) All of the above

GP&L sold $1,000,000 of 12 percent, 30-year, semiannual payment bonds 15 years ago. The bonds are not callable, but they do have a sinking fund which requires GP&L to redeem 5 percent of the original face value of the issue each year ($50,000), beginning in Year 11. To date, 25 percent of the issue has been retired. The company can either call bonds at par for sinking fund purposes or purchase bonds in the open market, spending sufficient money to redeem 5 percent of the original face value each year. If the yield to maturity (15 years remaining) on the bonds is currently 14 percent, what is the least amount of money GP&L must put in to satisfy the sinking fund provisionfor the next redemption? (Round the answer to the nearest whole number.)

A. $43,856 B. $50,000 C. $37,500 D. $43,796 E. $39,422

If a contract is not clearly unilateral or bilateral, the courts presume that the parties intended a unilateral contract

Indicate whether the statement is true or false