A family that earns $20,000 a year pays $400 a year in city wage taxes. A family that earns $40,000 a year pays $1,400 a year in city wage taxes. The city wage tax is a ________ tax.

A. progressive

B. regressive

C. proportional

D. benefits-received

Answer: A

You might also like to view...

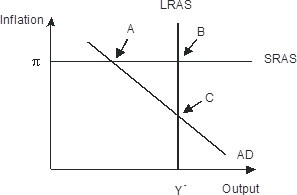

The economy pictured in the figure below has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; B B. recessionary; C C. recessionary; A D. expansionary; A

When firms in monopolistic competition incur an economic loss, some firms will

A) enter the industry and produce more products. B) exit the industry, and demand will increase for the firms that remain. C) exit the industry, and demand will decrease for the firms that remain. D) enter the industry, and demand will become more elastic for the original firms. E) exit the industry and other firms will enter.

Interlace, Inc produces and a unique soda. The company cannot price discriminate. The figure above shows Interlace's demand curve, marginal revenue curve, and marginal cost curve

The quantity of soda Interlace Inc will choose to produce is ________ because when this quantity is produced, ________. A) efficient; marginal social benefit exceeds marginal social cost B) efficient; marginal social benefit equals marginal social cost C) not efficient; marginal social benefit exceeds marginal social cost D) not efficient; marginal social benefit equals marginal social cost

Which of the following is not a feature of an efficient tax?

a. An efficient tax should minimize the excess burden of taxation. b. An efficient tax should have low compliance costs. c. An efficient tax should be equitable. d. An efficient tax should be easy to monitor and administer.