Paying interest on the reserves of commercial banks kept with the central bank allows the Fed to essentially place a floor on the federal funds rate

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

Fed purchases of bonds from the public, called open market operations:

A. tend to increase reserves in the system leading to reductions in interest rates. B. tend to reduce the money supply because the bonds are expensive to purchase. C. tend to reduce reserves in the banking system because all the Fed gets is more bonds. D. tend to increase bond prices but generally have no effect on bank reserves.

Which of the following is a true role of education in the process of economic development?

a. Education helps people to make better use of available resources. b. Increased focus on theoretical education lowers technical experience. c. Education makes people less receptive to new ideas. d. Investment in education crowds out the funds available for investing in physical capital.

When the money market is drawn with the value of money on the vertical axis, if money demand shifts leftward, then initially there is an

a. excess demand for money which causes the price level to rise. b. excess demand for money which causes the price level to fall. c. excess supply of money which causes the price level to rise. d. excess supply of money which causes the price level to fall.

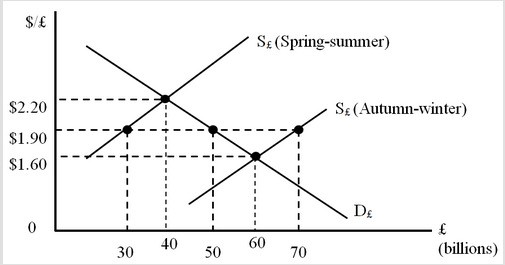

The figure below shows the foreign exchange market. D£ is the nonofficial demand curve for pounds. S£ (Spring-summer) and S£ (Autumn-winter) are the nonofficial supply curves of pounds during the spring-summer and autumn-winter seasons, respectively. In the Spring-summer period, what is the social gain if the British government maintains a fixed exchange rate at $1.90 per pound?

A. 3 billion dollars B. 3 billion pounds C. 10 billion pounds D. 6 billion dollars