B. Use the public demand schedule above and the following supply schedule to ascertain the optimal quantity of this public good. a. On the basis of the three individual demand schedules below, and assuming these three people are the only ones in the society, determine the collective demand schedule on the assumption that the good is a public good Instructions:

Answer:

a) For determining the collective demand schedule for the above three consumers, we need to add up the prices each consumer is willing to pay for a particular quantity of the commodity. In case of private goods we add up the quantities of the commodity at the given prices and do a horizontal summation across the demand curve, but as it is a public good, the prices are to be added up that each consumer of the society is willing to pay at the given quantities and a vertical summation is done to get the market demand curve.

The collective demand of the society is the Marginal Benefit of the society from such good whereas the supply of such commodity is known as Marginal Cost of the Government for providing such good. As all the consumers are willing to pay different prices for different quantities, a public good is always calculated with respect to its given quantity because a public good cannot be divided or distributed individually, but according to the needs of the consumers they can pay different prices for such good.

The collective demand schedule of the three consumers or the society as a whole is as follows:

Note: C1 - Individual 1, C2 - Individual 2 and C3 - Indivual 3

| Price | Quantity |

| $10 (C1) + $16 (C2) + $12 (C3) = $38 | 1 |

| $8 (C1) + $14 (C2) + $10 (C3) = $32 | 2 |

| $6 (C1) + $12 (C2) + $8 (C3) = $26 | 3 |

| $4 (C1) + $10 (C2) + $6 (C3) = $20 | 4 |

| $2 (C1) + $8 (C2) + $4 (C3) = $14 | 5 |

| $0 (C1) + $6 (C2) + $2 (C3) = $8 | 6 |

| $0 (C1) + $4 (C2) + $0 (C3) = $4 | 7 |

| $0 (C1) + $2 ( C2) + $0 (C3) = $2 | 8 |

So from the above table we can see the collective demand schedule of the society. assuming that the good is a public good.

b) When the Marginal Benefit is equal to the Marginal Cost, it is termed as the equilibrium point and the given quantity is the Optimal Quantity. When the consumers are willing to pay a collective price for the commodity irrespective of the individual contribution at a given quantity and the Government provides the same quantity of the commodity at that exact price, the given quantity at this point of equilibrium is known as optimal quantity.

Now we have found the correct demand schedule for the society and the supply schedule is given, so if we compare both the demand and supply schedule we can see that at prices $38, $32, and $26, the society is willing to consume 1, 2 and 3 units of the commodity respectively, whereas the supply is 10, 8 and 6 units respectively.

And for prices $14, $8, $4 and $2, the society is willing to consume 5, 6, 7 and 8 units respectively whereas the Government is only supplying 2 units at $14 and nothing at all for prices $8, $4 and $2.

It is only when the quantity is at 4 units, the society is willing to pay $20 collectively, and the Government is also willing to supply the same quantity at that price, i.e. demand and supply matches where marginal cost is equal to marginal benefit. So the optimal quantity is 4 units and the optimal price is $20.

You might also like to view...

If the U.S. government imposes a more restrictive import quota on Japanese video gaming systems, the ____________ curve for Japanese video gaming systems in the U.S. will shift ___________

A) supply; leftward B) supply; rightward C) demand; leftward D) demand; rightward

International goals become primary goals when:

A. foreign economies aren't doing well. B. the domestic economy is doing well. C. the domestic economy is in recession. D. there is international pressure.

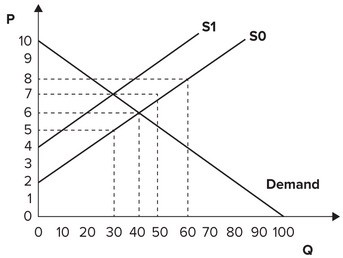

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $6 and a quantity of 40 units. If the government imposes a $2 per-unit tax on this product, it will collect tax revenue in the amount of:

A. $120. B. $80. C. $60. D. $100.

By the mid-1980s, the United States

A. changed from a creditor nation to a debtor nation. B. was neither a creditor nation or a debtor nation, as its current account and capital account were both valued at zero. C. was both a creditor nation and a debtor nation, as its balance of payments was equal to zero. D. changed from a debtor nation to a creditor nation.