Property taxes in the U.S. are ________

A) progressive

B) regressive

C) proportional

D) negative

B

You might also like to view...

Consider the following economic agents:

a. the government b. consumers c. producers Who, in a centrally planned economy, decides what goods and services will be produced with the scarce resources available in that economy? A) producers B) consumers C) the government, consumers, and producers D) consumers and producers E) the government

Consumer groups tend to lobby for

A) price floors. B) price ceilings. C) quantity quotas. D) taxes.

A major advantage of the corporation is

a. limited taxes. b. preferential treatment by state governments. c. limited liability of individual owners. d. limited numbers of owners and ease of decision making.

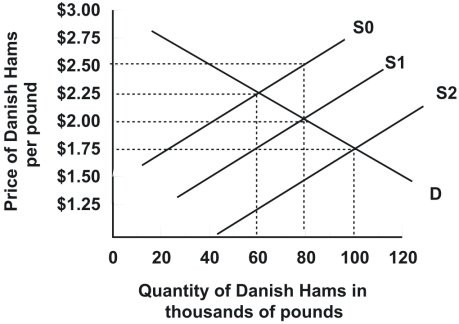

Refer to the following graph. Demand and supply are initially D and S1, respectively. Which of the following best describes the effect of a $0.50 per pound tariff on Danish hams imported into the United States?

Demand and supply are initially D and S1, respectively. Which of the following best describes the effect of a $0.50 per pound tariff on Danish hams imported into the United States?

A. Supply shifts from S1 to S0; quantity sold declines to 60 thousand pounds and price paid by consumers rises to $2.25 a pound B. Neither supply nor demand shift, but price paid by consumers declines to $1.50 a pound while quantity sold remains at 80 thousand pounds C. Supply shifts from S1 to S2; quantity sold rises to 100 thousand pounds and price paid by consumers declines to $1.75 a pound D. Supply shifts from S1 to S0; quantity sold declines to 60 thousand pounds and price paid by consumers rises to $2.50 a pound