Some of the members of Phar-Mor’s financial management team were former auditors for Coopers & Lybrand. (a) Why would a company want to hire a member of its external audit team? (b) If the client has hired former auditors, would this affect the independence of the existing external auditors? (c) How did the Sarbanes-Oxley Act of 2002 and related rulings by the PCAOB, SEC or AICPA affect a

public company’s ability to hire members of its external audit team? (d) Is it appropriate for auditors to trust executives of a client?

What will be an ideal response?

[a] A company may desire to hire a member of its audit teams for a number of reasons: (i) the auditor is familiar with the company, (ii) the auditor is typically highly competent and has experience with a

number of financial matters, and (iii) management has had the opportunity to work closely with the

auditor and probably has developed a strong relationship.

[b] When former auditors become clients, there is the possibility that independence can be threatened in

both fact and in appearance. Current auditors may be close personal friends with the former auditor

as a result of working on the same team for years. Further, the current auditors likely consider the

former auditor to be a person of competence and high integrity. As a result, the current auditors may

over rely on the representation of their former colleague. Finally, because the former auditor will be

intimately familiar with the audit approach, the potential for successfully hiding an accounting fraud or

mismanagement of funds may increase.

[c] Section 206 of the Sarbanes-Oxley Act of 2002 states that the CEO, CFO, Chief Accounting Officer

or person in an equivalent position cannot have been employed by the external audit firm during a

one year “cooling off ” period preceding the audit. The SEC rules extend this position to prohibit the

employment of such persons “in an accounting or financial reporting oversight role.” Also PCAOB

Rule 3600T, “Interim Independence Standards,” adopt the independence standards as described in the

AICPA Code of Professional of Conduct and Standards 1-3 of the Independence Standards Board.

[d] No, auditors should maintain healthy professional skepticism. AU-C Section 200, "Overall Objectives

of the Independent Auditor and the Conduct of an Audit in Accordance with GAAS," indicates that

professional skepticism is an attitude that includes a questioning mind and a critical assessment of audit

evidence. Section 200 also indicates that, “The auditor neither assumes that management is dishonest

nor assumes unquestioned honesty. The auditor can be expected to disregard past experience of the

honesty and integrity of the entity's management and those charged with governance. Nevertheless,

a belief that management and those charged with governance are honest and have integrity does not

relieve the auditor of the need to maintain professional skepticism or allow the auditor to be satisfied

with less than persuasive audit evidence when obtaining reasonable assurance" (A25). Therefore,

an audit team must objectively evaluate observed conditions and audit evidence, and follow up any

potentially negative indicators to determine whether or not financial statements are free of material

misstatement.

You might also like to view...

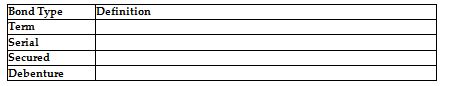

Provide a definition of each of the following types of bonds.

Describe the term personality

What will be an ideal response?

JK Developers and KL Designs, who are experts in architectural engineering, form a business agreement whereby they agree to work together for two years in order to complete the design of a planetarium. This is an example of a ________

A) franchise B) licensing agreement C) strategic alliance D) limited partnership

The ______ stage is the longest component of the interview.

Fill in the blank(s) with the appropriate word(s).