Which of the following circumstances would invalidate the constant cost of capital assumption?

A) the project will be financed entirely with debt.

B) The firm know that it's marginal tax rate will change from 25% to 34% next year.

C) the project will be financed entirely from retained earnings.

D) the price of the company's stock is extremely volatile.

Answer: B

You might also like to view...

The role of ________ is to ensure that those who enter into the marketplace are playing by the rules and conforming to the very conditions that ensure the market functions as it is supposed to function.

Fill in the blank(s) with the appropriate word(s).

According to ERC respondents, the most common form of retaliation experienced by those who reported misconduct came in the form of ______.

a. lost pay or bonuses b. lost job c. abuse by coworkers d. altered treatment by managers

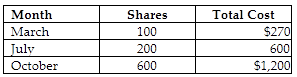

In April of this year, Edward sells 80 shares for $250. Edward cannot specifically identify the stock sold. The basis for the 80 shares sold is

Edward purchased stock last year as follows:

A) $160.

B) $184.

C) $216.

D) $240.

Explain the terms concentration and underutilization.

What will be an ideal response?