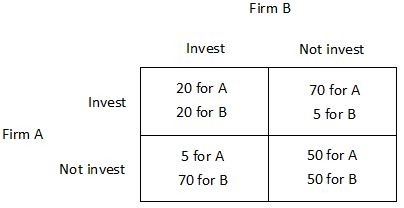

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy comes to firm B and claims to know what firm A has decided. Given that each firm already knows the payoff matrix, how much would this information be worth to firm B?

An industry spy comes to firm B and claims to know what firm A has decided. Given that each firm already knows the payoff matrix, how much would this information be worth to firm B?

A. $0

B. $70 million

C. $50 million

D. $30 million

Answer: A

You might also like to view...

The following table shows Jay's estimated annual benefits of holding different amounts of money.Average moneyholdings($)Total benefit($)1002020029300664004150044How much money will Jay hold if the nominal interest rate is 4 percent? (Assume he wants his money holdings to be in multiples of $100.)

A. $200 B. $300 C. $400 D. $100

A major weakness of the kinked demand curve model is that it does not explain how the equilibrium price, i.e., the price at the kink in the demand curve, is determined

Indicate whether the statement is true or false

Taking advantage of the built-in-loophole in emission taxes implies

A. opportunity to save on taxes by reducing emissions. B. opportunity to avoid taxes even without cutting emissions. C. opportunity to increase emission by paying more tax. D. opportunity to pay less by increasing emission.

What are four criticisms of the single tax on land?

What will be an ideal response?