Answer the following statements true (T) or false (F)

1. Many companies try to maintain investment grade status due to the significant yield differential when rated with a junk-bond status.

2. Bond ratings start with Aaa and end with C or Aaa1 and end with C3.

3. A low bond rating during a bad economic time means that the company will have to issue new bonds at a higher rate.

4. Yield spreads between investment grade and junk bond ratings are usually greater during economic boom periods.

5. A challenge for multinational corporations is trying to get the right financing for certain operating activity expectations.

1. TRUE

2. TRUE

3. TRUE

4. FALSE

5. TRUE

You might also like to view...

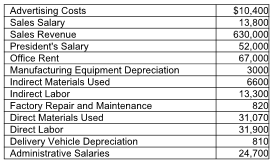

How much was Carried Away's manufacturing overhead?

The following information relates to Carried Away Hot Air Balloons, Inc.:

A) $19,900

B) $20,720

C) $23,720

D) $62,970

The following type of asset is a commodity:

A) Cocoa. B) Debentures. C) Preferred stock. D) Oil rights.

Which of the following is an example of passive fraud?

A) A homeowner tells a home buyer that the basement of the home never floods, when in fact the homeowner knows it has several significant leaks. B) An attorney fails to tell his or her client of an offer to settle a case. C) A thrift store sales clerk mistakenly tells a customer that a table is oak instead of pine. D)A car salesman tells a customer that he believes the latest model of certain pickup truck is more reliable than previous models.

Division R of Harris Corporation has the capacity for making 40,000 wheel sets per year and regularly sells 36,000 each year on the outside market. The regular selling price on the outside market is $89 per wheel set, and the variable production cost per unit is $56. Division S of Harris Corporation currently buys 6,000 wheel sets (of the kind made by Division R) yearly from an outside supplier at a price of $85 per wheel set. If Division S were to buy the 6,000 wheel sets it needs annually from Division R at $83 per wheel set, the change in annual net operating income for the company as a whole, compared to what it is currently, would be:

A. $96,000 B. $162,000 C. $108,000 D. $174,000