Tell whether permutations or combinations are being described.3 cards are selected from a deck of 52 to form a hand for a certain card game.

A. Permutations

B. Combinations

Answer: B

You might also like to view...

Use a trigonometric substitution to evaluate the integral.

A.  sin-1

sin-1  + C

+ C

B. tan-1  + C

+ C

C.  tan-1

tan-1  + C

+ C

D.  ln

ln  + C

+ C

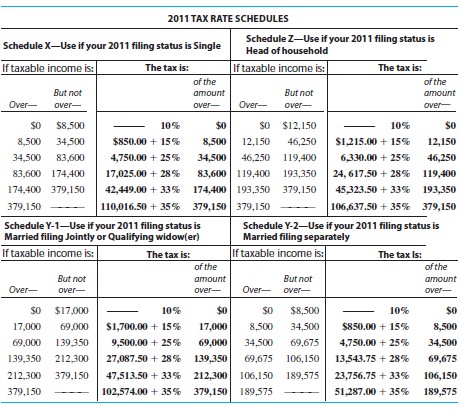

Find the tax. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the tax rate schedule.  Glenn and Natalie Dowling had combined wages and salaries of $69,992, other income of $5234, dividend income of $322, and interest income of $667. They have adjustments to income of $2411. Their itemized deductions are $8441 in mortgage interest, $1617 in state income tax, $852 in real estate taxes, and $1181 in charitable contributions. The Dowlings filed a joint return and claimed six exemptions.

Glenn and Natalie Dowling had combined wages and salaries of $69,992, other income of $5234, dividend income of $322, and interest income of $667. They have adjustments to income of $2411. Their itemized deductions are $8441 in mortgage interest, $1617 in state income tax, $852 in real estate taxes, and $1181 in charitable contributions. The Dowlings filed a joint return and claimed six exemptions.

A. $5076.95 B. $5150.60 C. $7328.25 D. $6890.60

Simplify the rational expression. If the rational expression cannot be simplified, so state.

A. x2 + x + 6 B. x2 - 6 C. x2 + 6 D. x + 6

Translate to a proportion and solve. Round to the nearest hundredth, if necessary.6572 is what percent of 3100?

A. 2.12% B. 21.2% C. 47% D. 212%