If the current market rate of interest is 10%, then the present value (PV) of this stream of cash flows is closest to ________

A) $10,114

B) $20,227

C) $24,272

D) $32,363

Answer: B

You might also like to view...

The concept of eight basic consumer rights is supported by American law, but not by international organizations such as the United Nations

Indicate whether the statement is true or false

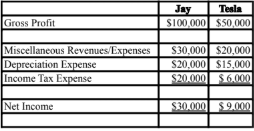

The amount of gross profit appearing on Jay's 2019 Consolidated Income Statement would be:

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2019 income statements of both companies are shown below.

On January 1, 2019, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%.

A) $147,000. B) $153,000. C) $147,600. D) $150,000.

Mann Inc. paid $7,250 to a leasing agent to negotiate Mann's 36-month lease for 18,000 square feet of space in a new commercial building. For tax purposes, Mann must:

A. Capitalize the $7,250 cost as a nonamortizable intangible asset. B. Deduct the $7,250 cost in the year of payment. C. Capitalize the $7,250 cost and amortize it over 36 months. D. Capitalize the $7,250 cost and depreciate it as 5-year recovery property.

Allowing individuals to deduct a standard deduction amount in lieu of itemizing their allowable personal deductions is an application of the

a. Administrative Convenience Concept. b. Wherewithal-to-Pay Concept. c. Annual Accounting Period Concept d. Capital Recovery Concept. e. Business Purpose Concept.