If the required reserve ratio is 20 percent, banks loan out all excess reserves, people hold no currency, and the Fed sells $5,000 worth of bonds to banks, what is the ultimate impact on the money supply?

a. The money supply will increase by $5,000.

b. The money supply will decrease by $5,000.

c. The money supply will increase by $25,000.

d. The money supply will decrease by $25,000.

e. The money supply will not change.

D

You might also like to view...

Assume a firm organizes all individuals by their willingness to pay (least to most). If the firm starts to perfectly price discriminate, what is likely to happen?

A) Consumers start to arbitrage amongst themselves. B) The firm's profits will be maximized. C) The firm's costs will be minimized. D) The firm starts to arbitrage with consumers.

Mika takes out a personal loan from her bank so that she can replace her furnace. From that point forward, Mika writes her bank a check for $150 every month until the loan has been satisfied. Mika’s payments demonstrate how money acts as a ______.

a. unit of account b. store of value c. medium of exchange d. means of deferred payment

The theory of perfect competition is built on several assumptions, including that

A) the individual firm can affect the price of the product it sells. B) any firm can easily enter or leave the industry. C) the individual firm can influence demand by advertising. D) there are few producers of an identical product. E) each firm must earn economic profits to remain in the industry.

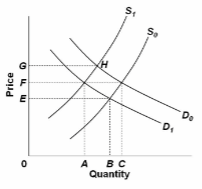

Refer to the diagram, which shows demand and supply conditions in the competitive market for product X. Other things equal, a shift of the supply curve from S 0 to S 1 might be caused by a(n):

A. increase in the wage rates paid to laborers employed in the production of X.

B. government subsidy per unit of output paid to firms producing X.

C. decline in the price of the basic raw material used in producing X.

D. increase in the number of firms producing X.