Imperfect asset substitutability assumes

A) the returns on foreign and domestic currency bonds are identical.

B) the returns on foreign and domestic currency are unrelated.

C) the risks of holding foreign and domestic currency are identical.

D) the risks of holding foreign and domestic currency are unrelated to returns.

E) the returns on foreign and domestic currency differ and are influenced by risk.

E

You might also like to view...

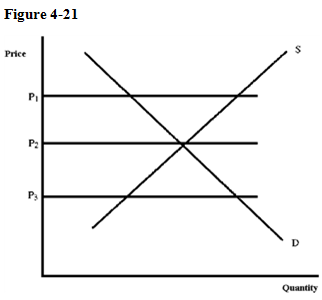

A. P1 B. P2 C. P3 D. There will be no shortage at the prices shown.

If food is measured on the horizontal axis of budget line diagram, and clothing is measured on the vertical axis, an increase in

a. the price of clothing will make the budget line steeper b. income will make the budget line steeper c. income will make the budget line flatter d. the price of food will make the budget line steeper e. the price of food will make the budget line flatter

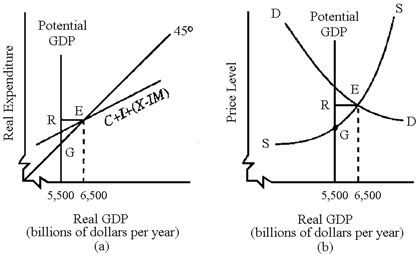

Figure 10-3

In Figure 10-3, we would expect the aggregate supply curve in graph (b) to eventually

a.

shift to the right, eliminating the recessionary gap.

b.

shift to the left, eliminating the inflationary gap.

c.

become steeper in the upper portion, eliminating the inflationary gap.

d.

become flatter in the upper portion, eliminating the recessionary gap.

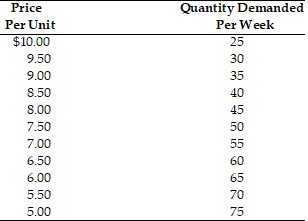

Refer to the above table. What is the absolute price elasticity of demand when a price rises from $9 to $9.50?

Refer to the above table. What is the absolute price elasticity of demand when a price rises from $9 to $9.50?

A. 2.85 B. 0.55 C. 2.57 D. 0.35