Stevens Company has had bonds payable of $10,000 outstanding for several years. On January 1, 2018, when there was an unamortized discount of $2,000 and a remaining life of 5 years, its 80% owned subsidiary, Matthews Company, purchased the bonds in the open market for $11,000. The bonds pay 6% interest annually on December 31. The companies use the straight-line method to amortize interest revenue and expense. Compute the consolidated gain or loss on a consolidated income statement for 2018.

A. $2,000 loss.

B. $3,000 gain.

C. $1,000 gain.

D. $3,000 loss.

E. $1,000 loss.

Answer: D

You might also like to view...

The heading of a work sheet might include the line "As of December 31, 20xx."

Indicate whether the statement is true or false

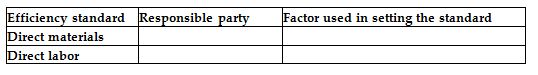

For each of the following efficiency standards, indicate which parties are responsible for the standard and list one factor that should be used in setting the standard.

Countries must rely on internationally accepted standards or recommendations for the protection of their plants, animals, and foodstuffs. The most notable are found in the _____

A) Japan's keiretsu B) Agricultural Act of 1948 C) The Law on the Entry and Exit Animal and Plant Quarantine D) Codex Alimentarius

The VBScript ________ function has the same purpose as JavaScript's window.prompt method

a) MsgBox b) InputBox c) Prompt d) PromptBox