What are Wal-Mart's immediate problems, and what are their long-term problems?

What will be an ideal response?

Wal-Mart does not seem to have too many immediate problems. It was already the world's biggest corporation and

Fortunes most admired company- and it strived to be everywhere and nowhere- hidden in plain sight, just your

friendly hometown superpower. The only issue it faced was that someone would probably decide that Wal-Mart had

too much power and the government could break up companies that got this big, for example a situation similar to

what happened to Microsoft. Some other problems involve lawsuits against them-these could prove to be difficult to

get away from owing to the sheer size of the company. Any number of people would be willing to sue Wal-Mart

over frivolous reasons. The only real problems that Wal-Mart faces in the short-term are to determine the right

strategy that will allow them accomplish the growth that they want.

In the long-term Wal-Mart faces the problem of saturation. How long will it be before they run out of ideas and

places to grow? The current CEO Lee Scott believes that Wal-Mart could be at least three times its current size. Is

his enthusiasm well grounded? Even if Wal-Mart's current annual growth rate of 15% is sustained, Wal-Mart would

grow to be twice its current size in five years. Wal-Mart already seems to be doing many things right by

experimenting in a variety of areas such as building neighborhood markets or ‘small marts’ with smartly designed

food/drug combos, conveniences like self checkout, honor system coffee and pastries, drive-through pharmacies and

half hour film processing to take advantage of smaller markets. If these experimental stores work out, they could be

rolled out nationally and prove to be a new revenue stream and the driver of future growth for Wal-Mart.

You might also like to view...

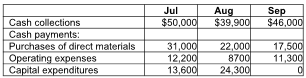

The cash balance on June 30 is projected to be $4500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the final projected cash balance at the end of August taking into consideration all the financing transactions.

Tomo, Inc. has prepared its third quarter budget and provided the following data:

A) $7558

B) $(7442)

C) $47,600

D) $15,000

Bridging involves seeing the other person's point of view.

Answer the following statement true (T) or false (F)

The average number of jobs in the work center for jobs listed in the following table under the shortest processing time (SPT) rule is ______.

a. 2.49 jobs

b. 2.98 jobs

c. 3 jobs

d. 3.5 jobs

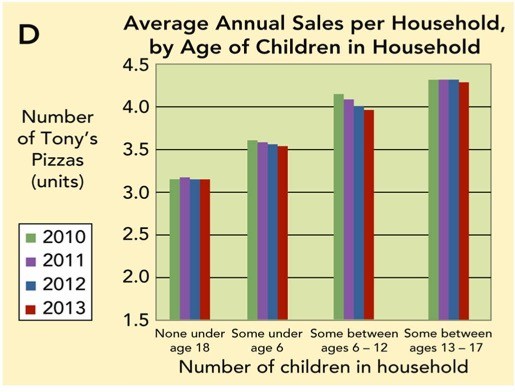

Figure 7-6D: Average Annual Sales per Household of Tony's Pizza, by Age of Children in HouseholdFigure 7-6D above shows average annual unit sales per household, by age of children in household for Tony's Pizza. Analyze this chart. What findings would you present to a supervisor?

Figure 7-6D: Average Annual Sales per Household of Tony's Pizza, by Age of Children in HouseholdFigure 7-6D above shows average annual unit sales per household, by age of children in household for Tony's Pizza. Analyze this chart. What findings would you present to a supervisor?

What will be an ideal response?