Which one of the following transactions would be included in GDP?

a. Ava pays $50 for a used picture frame at a neighborhood garage sale.

b. Ethan donates $500 to his town's junior college scholarship fund.

c. Emily pays $500 to fix the front end of her car damaged in a recent accident.

d. Mia pays $5,000 to purchase 100 shares of Microsoft stock.

C

You might also like to view...

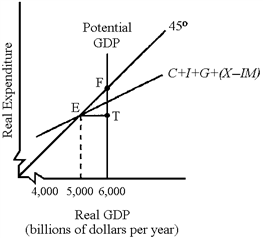

Figure 11-1

?

A. increasing Social Security payments. B. decreasing defense spending. C. decreasing personal income taxes. D. All of the above are correct.

A monopolistically competitive firm

A) cannot make a positive economic profit in the long run because of entry. B) can make a positive economic profit in the long run because it sells a differentiated good. C) can make a positive economic profit in the long run because there are only a few firms in the industry. D) cannot make a positive economic profit in the long run because it sells a homogeneous good.

Firms in monopolistic competition always will

A) make an economic profit. B) set their price equal to their marginal cost. C) set their price above their marginal cost. D) produce at the minimum average total cost.

An optimal corrective tax should be placed on _____

a. the sellers of the externality-generating activity b. the inputs into the externality-generating activity c. the externality-generating activity d. the purchasers of the output of the externality-generating activity