A bond offers a $40 coupon, has a face value of $1,000, and 10 years to maturity. If the interest rate is 5.0%, what is the value of this bond?

What will be an ideal response?

Realizing that the price of the bond is the sum of the present value of all payments we simply calculate the present value of each payment and sum these. With the help of a financial calculator or spreadsheet if necessary, we see the value of the bond is $922.78.

You might also like to view...

Consider the following methods of pollution reduction:

a. the government sets a target for maximum emissions b. the government mandates the installation of specific pollution abatement equipment c. the government imposes a per unit tax on the good that creates pollution d. the government gives firms a tax rebate for every unit of pollution abated Which of the above is an example of a command-and-control approach to reducing pollution? A) a only B) b only C) a and b only D) a, b, and d only E) a, b, c, and d

The peak oil hypothesis says that the annual world production of oil

a. will not peak for several hundred years. b. peaked in the past two decades and is now rapidly declining. c. will peak in the coming decades and then decline. d. is now peaking and a major decline is imminent.

The demand curve facing a perfectly competitive firm is

a. vertical at the equilibrium b. perfectly inelastic c. downward sloping d. horizontal at the market price

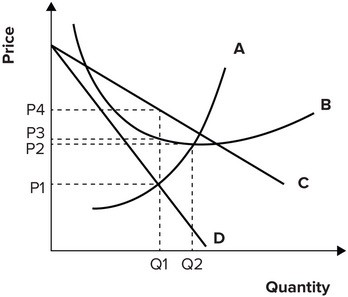

Refer to the graph shown. To maximize profit, the monopolistically competitive firm represented in this graph will produce:

A. Q1 and set price equal to P4. B. Q1 and set price equal to P3. C. Q2 and set price equal to P2. D. Q1 and set price equal to P1.