When a central bank is acting as a lender of last resort, it is:

A. providing banks with Treasury bills for free.

B. buying long-term Treasury bonds and selling short-term Treasury notes.

C. buying Treasury bills directly from the public.

D. providing banks with liquidity to meet their obligations.

Answer: D

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. If the demand curve for a good is relatively flat, a small change in price results in a relatively large change in quantity demanded 2. If safer cars reduce a driver's chance of dying in an accident, then there will be fewer driver fatalities. 3. If one wants to apply the theoretical side of economics by examining data, they use a family of statistical techniques called econometrics. 4. A sales tax causes the demand curve to shift upwards by the amount of the tax. 5. As defined by economists, the supply of corn refers to the number of bushels of corn that farmers bring to the market.

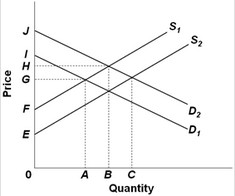

Use the following supply and demand graph to answer the question below. S1 and D1 represent the current market supply and demand, respectively. S2 and D2 represent the socially optimal supply and demand. The positions of the graphs indicate that there is (are) external

S1 and D1 represent the current market supply and demand, respectively. S2 and D2 represent the socially optimal supply and demand. The positions of the graphs indicate that there is (are) external

A. benefits from production and external costs from consumption of the product. B. costs from production and external benefits from consumption of the product. C. costs from production and consumption of the product. D. benefits from production and consumption of the product.

Which of the following would not lead to a shift in an economy's production possibilities curve?

a. Change in technology. b. Change in the number of resources. c. An earthquake. d. Improvement in the education level. e. Change in the composition of current output.

Market failure refers to a situation in which the market does not allocate resources efficiently

a. True b. False Indicate whether the statement is true or false