Suppose that Tracy and Pat start a business. Because of a series of bad decisions by Tracy, the company goes bankrupt, owing a total of $50,000. Tracy is penniless and Pat is a millionaire

If the company were organized as a partnership, Pat would be responsible for A) over $1 million of debt.

B) $50,000 of debt.

C) $25,000 of debt.

D) $0 of debt.

B

You might also like to view...

All else equal, as the price of a product falls, the quantity supplied decreases

Indicate whether the statement is true or false

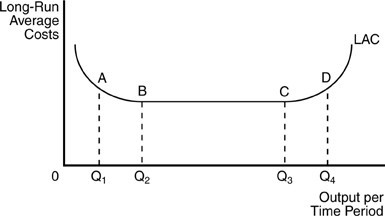

_____ is the locus of the minimum points of various short-run average cost curves depicting different plant sizes

a. Long-run marginal cost b. Expansion path c. Long-run average cost d. Isocost

What did the Taft-Hartley Act of 1947 restrict?

a. workplace speech b. federal taxes c. union power d. workers’ rights

In the above figure, for any output level less than Q2, this firm experiences

In the above figure, for any output level less than Q2, this firm experiences

A. decreasing long run average costs. B. diseconomies of scale. C. constant economies of scale. D. economies of scale.