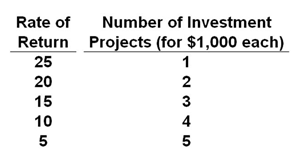

Refer to the below table and information. The number of investment projects this firm would undertake will decrease from 4 to 2 if the interest rate in the loanable funds market:

The following table shows the projected rate of return and number of investment projects which might be undertaken by a small firm. Each project requires an investment of $1,000.

A. Increases from 10 percent to 20 percent

B. Decreases from 20 percent to 10 percent

C. Decreases from 15 percent to 10 percent

D. Increases from 15 percent to 20 percent

A. Increases from 10 percent to 20 percent

You might also like to view...

Purchasing power parity is defined as

A) an equal value of money across currencies. B) a currency whose value rises. C) an equal value of interest rates across currencies. D) a currency whose value falls. E) a constant value for a currency.

How do markets for insurance use no-claim bonuses to cope with private information?

What will be an ideal response?

If you knew that an investment was going to pay you $1,188,757 in 20 years, and you knew that the annual interest rate over that time would be 2 percent, you could calculate the present value to be:

A. $1,000,000. B. $1,500,000. C. $905,000. D. $800,000.

The expectations effect is the

A) increase in the interest rate brought on by an expected increase in Real GDP. B) increase in the interest rate due to a higher expected inflation rate. C) decrease in the interest rate due to an expected increase in the supply of loanable funds. D) idea that people form their expectations of inflation by considering all available information about past, present, and future inflation. E) idea that people form their expectations of inflation by considering only information about past inflation experience.