Outdoor World experienced the following business events during its first year of operation. The company uses a perpetual inventory system.1) Purchased merchandise on account for $170,000.2) Sold inventory costing $124,000 for $208,000 on account.3) Paid transportation-out cost of $7,000 on goods sold.4) Paid operating expenses of $55,200.5) Sold land for $45,400 that had cost $50,000.6) A count of the inventory revealed that there was $45,800 of inventory on hand at the end of Year 1.Required:a) What was Outdoor World's net income for Year 1?b) What was the gross margin and the gross margin percent for Year 1?c) What amount of inventory will be reported on the balance sheet for December 31, Year 1?d) Prepare a multistep income statement for Year 1.

What will be an ideal response?

a) Inventory shrinkage = $170,000 ? $124,000 ? $45,800 = $200

Cost of goods sold = Purchases ? cost of goods sold + Write-off of inventory shrinkage

Cost of goods sold = $124,000 + $200 = $124,200

Loss on the sale of the land = $45,400 ? $50,000 = $4,600

Net income = Sales ? Cost of goods sold ? Operating expenses ? Transportation-out +/? Nonoperating items (here, the loss on the sale of the land)

Net income = $208,000 ? $124,200 ? $55,200 ? $7,000 ? $4,600 = $17,000

b)

Gross margin = Net sales ? Cost of goods sold

Gross margin = $208,000 ? $124,200 = $83,800

Gross margin percentage = $83,800 ÷ $208,000 = 40.29%

c) The inventory shown on the balance sheet will be $46,000. However, the amount on hand of $45,800 indicates a loss of inventory (shrinkage) of $200

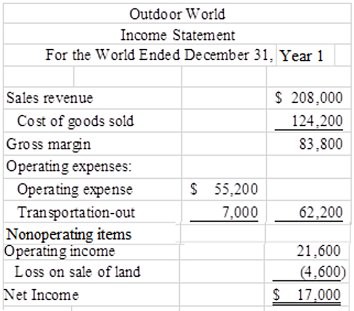

d)

You might also like to view...

What is the distinguishing characteristic between accounts receivable and notes receivable?

a. Accounts receivable are usually current assets while notes receivable are usually long-term assets. b. Accounts receivable require payment of interest if not paid within the usual credit terms. c. Notes receivable result from credit sale transactions for merchandising companies, while accounts receivable result from credit sale transactions for service companies. d. Notes receivable result from a written promise to pay within a specified amount of time.

Which of the following facts would require a lessor to classify a lease as an operating lease?

A) Important uncertainties exist about unreimbursable costs yet to be incurred by the lessor. B) No bargain purchase option is provided for by the lease agreement. C) The lease term is 65% of the estimated economic life of the leased property. D) The sum of the minimum lease payments is 90% of the fair value of the leased property to the lessor.

In Japan, what should be done is called ________, while what one really feels, which may be quite different, is called ________.

A. tatemae; honne B. ringisei; tatemae C. honne; ringisei D. honne; tatemae

Identify the four costs of quality. Which one is hardest to evaluate? Explain

What will be an ideal response?