Terry owns a stock that is expected to earn 8.7 percent in a booming economy, 9.2 percent in a normal economy, and 12.6 percent in a recessionary economy. Each economic state is equally likely to occur. What is his expected rate of return on this stock?

A) 10.38 percent

B) 11.90 percent

C) 10.17 percent

D) 9.98 percent

E) 11.01 percent

C) 10.17 percent

You might also like to view...

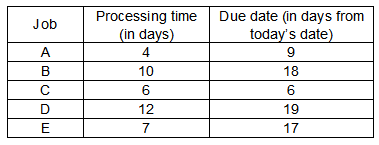

Determine the longest processing time (LPT) sequence for the jobs listed in the following table.

a. A-B-C-D-E

b. D-B-C-A-E

c. D-B-E-C-A

d. A-D-C-B-E

An examination of strategic issues such as possible gaps between a process's competitive priorities and current competitive capabilities falls in the:

A) document process phase of process analysis. B) evaluate performance phase of process analysis. C) redesign process phase of process analysis. D) identify opportunities phase of process analysis.

The contract rate on previously issued bonds changes as the market rate of interest changes.

Answer the following statement true (T) or false (F)

Ordinarily, "ignorance of the law is an excuse," or a valid defense to criminal liability.

Answer the following statement true (T) or false (F)