Refer to Figure 4-15. As a result of the tax, is there a loss in consumer surplus?

A) No, because the producer pays the tax.

B) No, because the market reaches a new equilibrium

C) No, because consumers are charged a lower price to cover their tax burden.

D) Yes, because consumers pay a price above the economically efficient price.

D

You might also like to view...

The self-correcting tendency of the economy means that falling inflation eventually eliminates:

A. exogenous spending. B. recessionary gaps. C. expansionary gaps. D. unemployment.

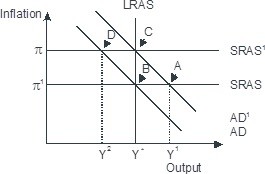

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

The primary reason why the Fed cannot systematically surprise the public with its monetary policy is

A) the nonneutrality of money. B) the presence of productivity shocks that generate real business cycles independent of the monetary side of the economy. C) the presence of rational expectations among the public. D) the presence of propagation mechanisms within the economy.

Which of the following is NOT true of a fixed payment loan?

A) The borrower is required to make regular periodic payments to the lender. B) The payments made by the borrower include both interest and principal. C) The borrower is left with a substantial unpaid principal at the maturity of the loan. D) A home mortgage is an example of fixed payment loan.