George and Betty ask you for financial advice. What would you tell them to do?

George and Betty, a middle-aged couple, have watched their savings account dwindle over the years. They both make good incomes and can't understand why they aren't saving more each month. Below is their financial information to complete an income statement.

Gross monthly income: $8,000

Income taxes withheld monthly: $2,300

Monthly interest income from investments: $100

Monthly insurance payments: $700

Monthly housing expenses: $4,500

Monthly food expenses: $800

Miscellaneous expenses: $400

A) They should hire a Certified Financial Planner to assist them.

B) Nothing. With their income they are in good shape financially.

C) They need to live within their means.

D) Both A and C would be good advice for them.

Answer: D

You might also like to view...

Which of the following terms is least preferred by unions when describing efforts to make joint decisions in the workplace?

A. labor-management partnership B. labor-management involvement C. labor-management participation D. labor-management cooperation

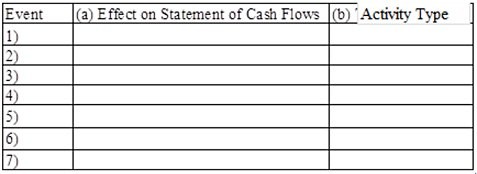

The following transactions apply to Kellogg Company.1) Issued common stock for $20,000 cash2) Provided services to customers for $38,000 on account3) Purchased land for $15,000 cash4) Incurred $29,000 of operating expenses on account5) Collected $35,000 cash from customers for services provided in event #26) Paid $27,000 on accounts payable7) Paid $2,000 dividends to stockholdersRequired:a) Identify the dollar amount effect on the statement of cash flows, if any, for each of the above transactions. b) If applicable, indicate whether each transaction involves operating, investing, or financing activities.

What will be an ideal response?

Ads are usually considered:

a. implied contracts b. fully binding contracts c. partially binding contracts d. express contracts e. none of the other choices are correct

A standard normal distribution is a normal distribution with

a. a mean of 1 and a standard deviation of 1 b. a mean of 0 and a standard deviation of 0 c. any mean and a standard deviation of 1 d. any mean and any standard deviation