The presence of ________ creates a difference in the value between the market price and the factor cost of a product

A) indirect taxes and consumption

B) subsidies and direct taxes

C) corporate profits and subsidies

D) indirect taxes and subsidies

D

You might also like to view...

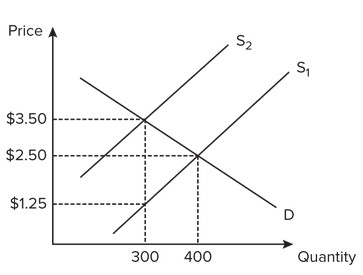

Use the following graph for a competitive market to answer the question below. Assume the government imposes a $2.25 tax on suppliers, which results in a shift of the supply curve from S1 to S2. The amount of the tax paid by the seller is

Assume the government imposes a $2.25 tax on suppliers, which results in a shift of the supply curve from S1 to S2. The amount of the tax paid by the seller is

A. $2.25. B. $0. C. $1.00. D. $1.25.

In the oil tanker industry, large companies have lower risk and are able to optimize vessel utilization. If consolidation allows companies to lower their long-run average total costs, this is an example of:

a. the opportunity costs of mergers. b. the increase in utility of managers by being able to control larger companies. c. the dangers of oil tankers to the environment. d. the economies of scale in the oil tanker industry. e. the law of diminishing returns.

The fact that over the long run the return on common stocks has been higher than that on long-term U.S. Treasury bonds is partially explained by the fact that:

A. There are regulations on the interest rates U.S. Treasury bonds can offer. B. The risk premium is higher on common stocks. C. A lot more money is invested in common stocks than U.S. Treasury bonds. D. Risk-averse investors buy more common stock.

A monopoly incurs a marginal cost of $1 for each unit produced. If the price elasticity of demand equals -2.0, the monopoly maximizes profit by charging a price of

A) $1.00. B) $1.50. C) $2.00. D) $3.00.